[toc]

Why is stress in the workplace an important conversation…

In parallel with society’s improving understanding of mental health, concern over stress levels at work is under the spotlight. Stress is known to decrease employee productivity, motivation and engagement and increase employee sick days.

Created in line with International Stress Awareness Week (1), and National Stress Awareness Day (2) 2019 in the UK, Dolan Contractor Group conducted a comparative survey into the difference between the prevalence, causes, and support networks for work-related stress that are available to either freelancers and contractors or permanent workers.

Why contracting and freelancing has become the choice of many…

Now more than ever before, workers are searching to find a healthy work/life balance and being able to work as a freelancer or as a contractor is seen as the dream for ultimate control and flexibility. This is reflected in the number of self-employed workers reaching a record high of 4.93 million (3) in 2019 and this figure is predicted to continue to rise.

Freelancers and contractors have flourished in today’s society due to a desire for flexible working and the technology now available to make this easier. With impending changes to IR35 tax rules coming into force in April 2020, many freelancers and contractors may be asked by their employer to take on a permanent position or work via an umbrella company, calling into question whether support should be given by an employing company.

With this in mind, we undertook an anonymous survey of employees from 140 UK companies — half of which were contractor and freelance workers and half of which were permanent employees. We asked them whether they have had experience of excessive stress at work and, if they had, the reasons for this stress.

Who suffers the most from excessive stress?

Our survey found that the issue of excessive stress is prevalent at high levels in both permanent employees and contractor/ freelance employees.

When we asked respondents if they have been affected by excessive stress the results showed that over 4 in every 5 permanent employees have had to deal with excessive stress caused by work. 19 in every 20 contractors or freelancers surveyed have experienced excessive stress from their work.

Pressure in the workplace is unavoidable due to the nature of many jobs and our desire to do well. However, when this pressure is excessive it can lead to potentially damaging levels of stress.

For permanent employees, any work-related stress needs to be addressed by Human Resources. Freelancers and contract workers have greater control over work/life balance and so need to make changes to ensure that their work and heath doesn’t suffer from excessive levels of stress.

We’ve looked into the causes of excessive stress behind these results and the different reasons given by contractors/freelancers and permanent employees in our survey.

What are the causes of excessive stress?

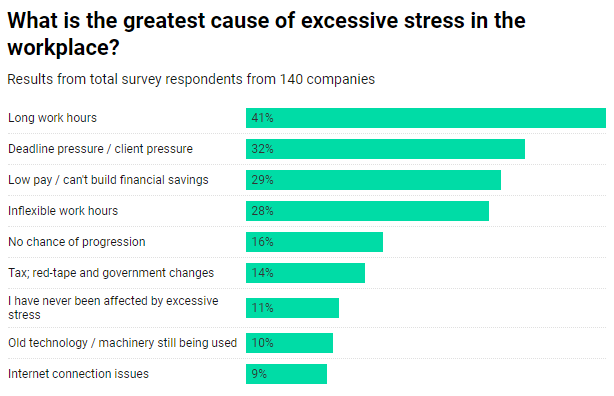

Of those surveyed, ‘long work hours’ was the greatest cause of workplace stress from all workers — freelancers, contractors and permanent workers.

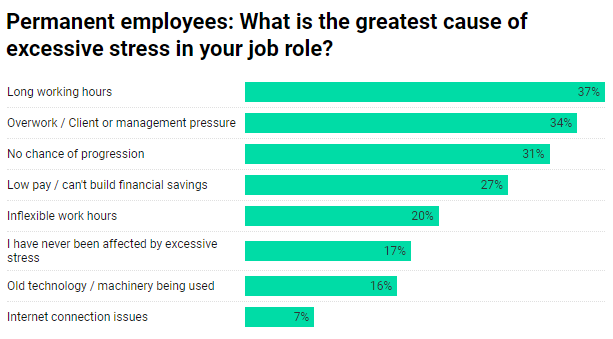

When permanent staff were asked what the greatest cause of excessive stress in their job role was, the majority answered ‘long work hours’ (37%). Next highest was ‘overwork/client or management pressure’ (34%), followed by ‘no chance of progression’ (31%).

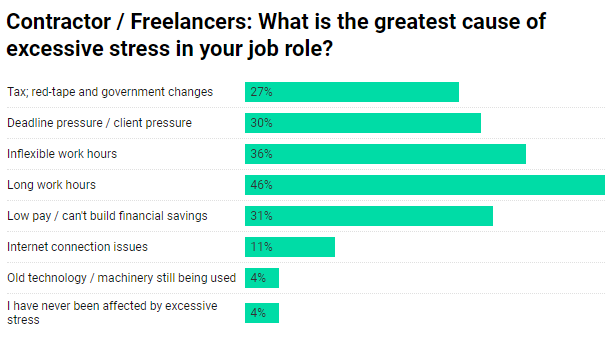

The majority of freelancers and contractors answered ‘long work hours’ (46%) and next highest was ‘inflexible work hours’ (35%). Only 4% of contractor and freelance employees answered that they had never been affected by excessive stress, compared to 11% of permanent employees.

With the increasing demand for flexible workspaces and for companies to support the wellbeing of their staff, companies who ignore this put themselves at risk of losing top talent, whether permanent or employed contractors/freelancers, to workplaces that offer a better work/life balance, flexible working hours, and a focus on support for employee wellbeing.

In order to provide flexibility, companies can ask what hours work best for a job candidate when hiring and then tailor the job to those hours. Other businesses might have to stick to core office hours but could offer flexible start and finish times. Another possibility for employers is to provide laptops for their staff to work on while in the office as well as out of hours and at different locations. All these possibilities could apply to whoever the company are employing — whether on a freelance, contract or permanent basis.

Are there gender differences in excessive stress?

Contractors / freelancers

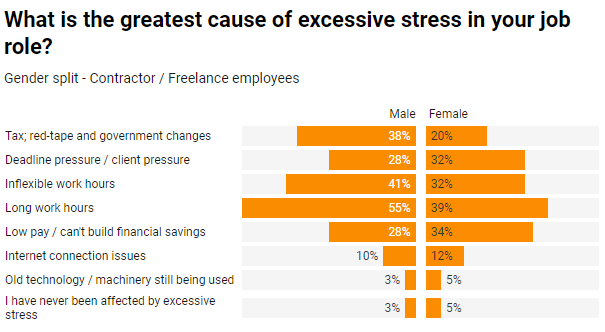

The highest cause of excessive stress for the male and female contractors and freelancers surveyed is long working hours. Yet more men than women rate this as a cause of excessive stress – 55% of men and 39% of women.

Interestingly, male contractors/freelancers are nearly twice as likely to suffer from excessive stress due to tax, red tape, and government changes than women. This could intensify with the upcoming IR35 changes in April 2020.

Many contractors who have chosen to work in this way to suit their lifestyle may be feeling concerned about the shifting of onus to medium and large employers to decide their contractor status, and whether they need to switch to full-time employee status. This could lead to employers losing experienced and talented contractors and freelancers to other companies, who aren’t pushing them to work as a permanent employee or are exempt from the new IR35 rules due to organisation size.

The key message here is that stress leads to an unproductive workforce. For companies to attract, retain and get the best from contracting talent the employer should be aware of the stresses that are placed upon the workers and support them where necessary.

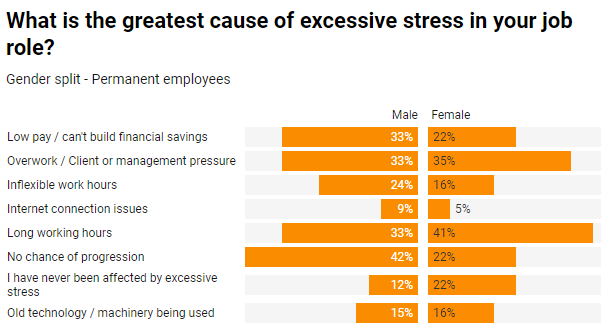

Permanent employees

Over 2 in every 5 male permanent employees answered that the greatest cause of excessive stress came from no chance of progression in their job role. This number halves for the number of female respondents who answered with the same response.

For female permanent employees, long working hours are seen as the greatest reason for excessive stress at 41% (compared to 39% of freelancers/contractors). This is followed by overwork and management pressure, which 35% of respondents selected as a cause of excessive stress.

A greater number of female respondents answered that they had never been affected by excessive stress, with 22% compared to just 12% of male permanent employees – of whom 33% found long working hours to cause excessive stress.

What does this tell us?

Female contractor workers are less likely to suffer from excessive stress due to long working hours when compared to permanent workers. It is still predominantly women who take time off work as the main carers for children within a family, so they have to set their working hours around childcare, which is made possible by freelancing and contracting.

Around 15% of all freelancers are mothers — there are now over 287,000 mothers freelancing in the UK. Working as a freelancer or contractor enables mothers to benefit from flexibility to earn while spending more time with their children. Self-employment also allows the mother to continue to progress her career. In a permanent role she may have had no option but to stop working, due to childcare costs or simply the desire not to miss out on her children’s lives.

More than this, data from the study shows us that more male than female contractors and freelancers say that inflexible work hours cause them excessive stress. This could indicate that employers are less understanding of men’s desire to work around family or other commitments. Only 2% of parents take shared parental leave in the UK.

Are there differences between SMEs and large companies for employee stress?

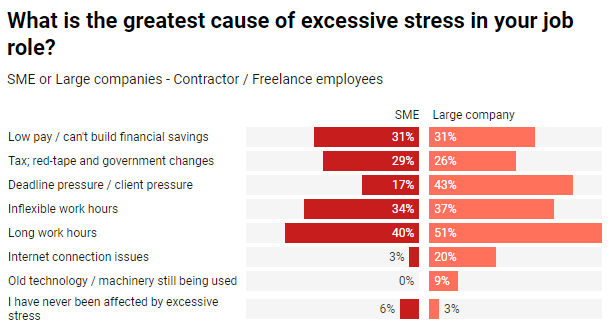

Contractor / freelance

Data from the study reveals the added stress that undertaking contract or freelance work for a large company brings. The greatest cause of stress for contractors working for a large company was client or deadline pressure (53%), compared to just 17% working with SMEs.

Likewise, the next biggest cause for excessive stress for contractors working for a large company are the long hours (cited by 47% of contractors). Working on a project where the costs for a large company are much bigger if the project is delayed, longer working hours will be needed to make those tight deadlines and keep the client happy. However, by working as a contractor you could choose to take a break when the project has finished. For example, some contractors work 3 months on and then 3 months off for a better work/life balance.

Technical issues also create more stress for those working with large companies compared to SMEs, with over 1 in every 4 respondents contracting or freelancing for a large company stating that internet issues were a cause of stress. This compares to less than 1 in every 20 of SME contractors and freelancers.

Larger companies will tend to pay more, but this will have a knock-on effect regarding technical issues – as there will be more at stake with projects. Mistakes and delays will potentially cost more money.

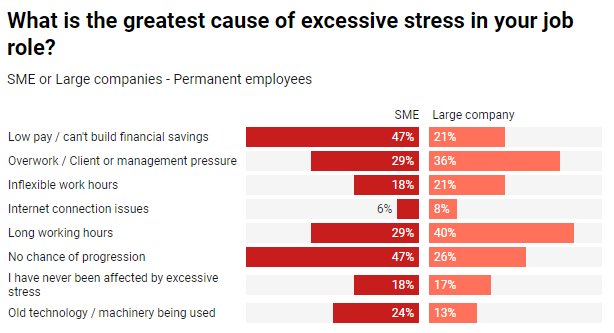

Permanent employees

As you can see from the graph below, low pay (47%) jointly with ‘no chance of progression’ (47%) are the highest causes of excessive stress for permanent employees at SMEs.

With permanent employees in large companies, long working hours (40%) was the highest cause of excessive stress. Again, freelancing or contracting provides greater control over working hours and the choice of accepting work or saying no and setting deadlines.

Contractors and freelancers do not fall within the future IR35 changes when working for small companies, which further increases the earning potential for a permanent employee to move to a contracted or freelance basis.

What does this tell us?

It is well-known that freelancers and contractors are better paid than permanent employees. Perhaps this should be a consideration for those feeling unacceptable amounts of stress for financial reasons, especially with their perceived lack of career progression which must be demotivating (potentially leading to less productivity or more mistakes being made).

With the data from the study showing that contractors and permanent workers for large businesses are experiencing a greater amount of excessive stress, it will become increasingly important for companies to put in place a support system that serves not just permanent staff but those contracted by the company as well.

What support is there for excessive workplace stress?

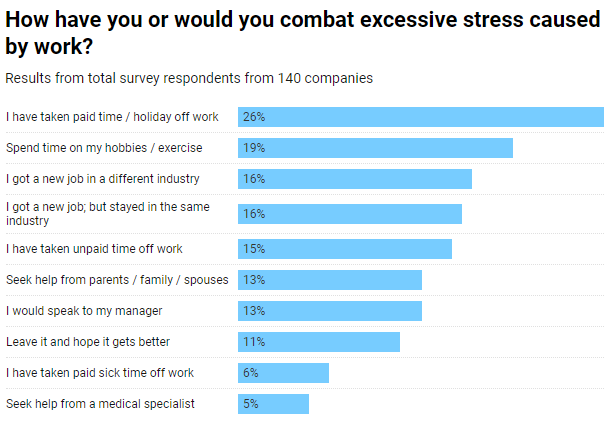

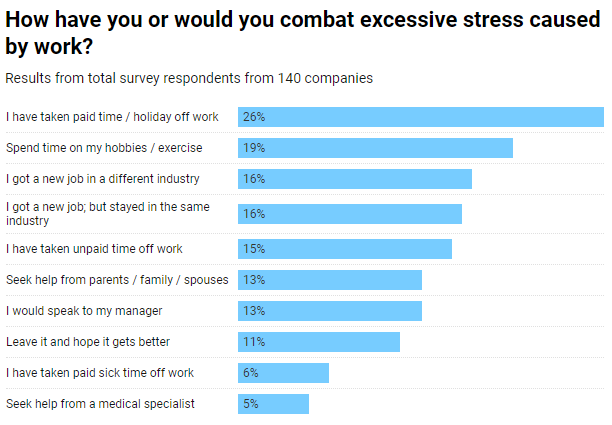

As well as identifying the reasons for excessive stress in the workplace, we asked respondents of the study how they combat excessive stress caused by work. In doing this, we hoped to show what workers relied on and how companies can act to further support their employees.

Results show that over a quarter of workers (26%) will rely on their paid holiday time to combat stress. Surprisingly, 16% of respondents would leave a company if they weren’t given support for excessive stress. The same percentage answered that they would look to move industry.

Worryingly, only 1 in every 20 of respondents answered that they would seek help from a medical specialist is they were suffering from excessive stress. This contrasts with the fact that two times as many people – one in every ten – would ‘leave it and hope it gets better’.

Contractors and freelancers

Nearly 1 in every 5 freelancers surveyed would not seek help for excessive stress in the ‘hope that it gets better’, whereas this figure reduces to 1 in every 20 for permanent staff. Without an HR department, freelancers and contractors don’t have an immediate and readily available support network for excessive stress, which causes many to not seek the help needed.

1 in every 3 respondents had to take unpaid time off to combat excessive stress caused by work. Although unpaid, there would be no official time constraints which relieves pressure on the contractor or freelancer and allows them to spend the time needed to fully recover.

Also found from Contractor and Freelance workers:

- Freelancers suffering from stress or mental health problems are more reliant on support from friends and family – 26% answered that they would seek help from family members

- 30% have taken unpaid time off work to combat excessive stress. None of the permanent workers had to do the same.

- Nearly 1 in every 5 would simply leave it and hope it gets better if suffering from excessive stress

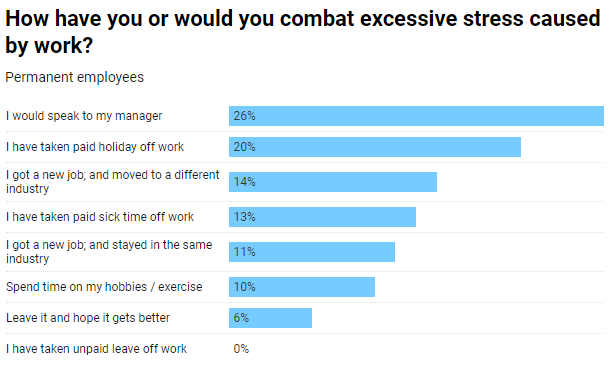

Permanent employees

From the respondents who were permanent staff, 0% answered ‘I have taken unpaid leave from work’. 1 in every 5 respondents stated that they had taken a paid holiday from work to combat stress, and just over 1 in every 8 had taken paid sick time from work for stress. However, paid holiday is limited for a permanent employee.

- The majority of permanent workers (26%) spoke to their managers as a way to combat stress at work

- Permanent staff are able to take paid holiday off work to combat stress (20%), while contractors and freelancers can factor in holiday when they need it

- 13% of permanent company employee respondents have had to take sick leave off work because of excessive stress

What can companies do to support and combat excessive stress in the workplace?

It is understood that by using effective stress management skills there will be less chance of poor decision making or customer complaints, even in the most stressful situations. However, to prevent valuable staff from leaving, HR departments must understand that stress-reduction must be a priority.

The results of the survey show that of permanently employed respondents, just over 11% sought out a new job in the same industry, and 14% moved industry altogether.

Top ways for companies to reduce stress on their workforce:

- ✔ Encourage flexible hours

- ✔ Allow remote working

- ✔ Give employees exercise incentives

- ✔ Ensure managers lead by example, taking breaks and holiday

- ✔ Offer wellbeing programmes

- ✔ Organise social events

- ✔ Work to improve communication so staff feel able to talk about problems

How can contractors / freelancers ensure they’re reducing stress levels?

- ✔ Join professional networks to air stressful issues and for peer support

- ✔ Put contingency plans in place for finances

- ✔ Choose to work in a professional hub rather than at home if that suits

- ✔ Create an invoicing system with strong terms and conditions

- ✔ Take regular breaks and holiday

- ✔ Incorporate exercise into each day

- ✔ Keep on top of paperwork, invoices and taxes

- ✔ Outsource or hire someone to help you

Once a freelancer or contractor is established they can also usually afford to turn down work when they want to, or if a client treats them badly, especially when they are being paid higher take-home pay as this allows them to potentially save and put money aside.

IR35

Designed to prevent ‘disguised employment’, the off-payroll working rules (IR35) were updated across the public sector in 2017 to ensure that all employees working in the same way are taxed consistently. The upcoming changes in 2020 will apply the same system to the private sector.

Many contractors work through Personal Services Companies (PSCs) and the IR35 update aims to prevent their misuse – by placing the responsibility of declaring a worker’s tax status on the hirer rather than the contractor. This could mean that contractors who are employed by medium and large sized companies (small companies are excluded from the IR35 bracket) are taxed as full-time permanent employees.

This calls into question whether contractors and freelancers engaged by medium and large companies that fall under the IR35 rules should be given the same company benefits and support that permanent staff are given.

IR35 guides for advice:

References:

- Details about International Stress Awareness Week can be found here

- Details about the UK National Stress Awareness Day 2019 can be found here

- Labour Market Economic Commentary May-2019